The word “e” is an interesting one. For a fruit vendor running his shop at the corner of the road, an invoice generated from MS Word vs. the manual one on a paper is an e-invoice, and for a small business owner who has just started using a free accounting software, an invoice from that system vs. the one from the MS Word is an e-invoice.

Now as we have touched upon various angles through which an e invoice can be perceived, its important to understand what an e invoice is from GAZT lens and that brings us to our 1st point : the definition of e-invoice as per the GAZT regulations.

1. What exactly is an e-invoice?

According to the GAZT regulations, “the electronic invoice is defined as an invoice generated, stored, and amended in a structured electronic format through an electronic solution, which includes all the requirements of a tax invoice. A handwritten or scanned invoice is not considered an Electronic Invoice”.

Language Used for e-invoice

XML (e Extensible Markup Language), the primary purpose of which is the transportation of data in both machine-readable and human-readable format, is the language in which these e-invoices will be created as per the GAZT.

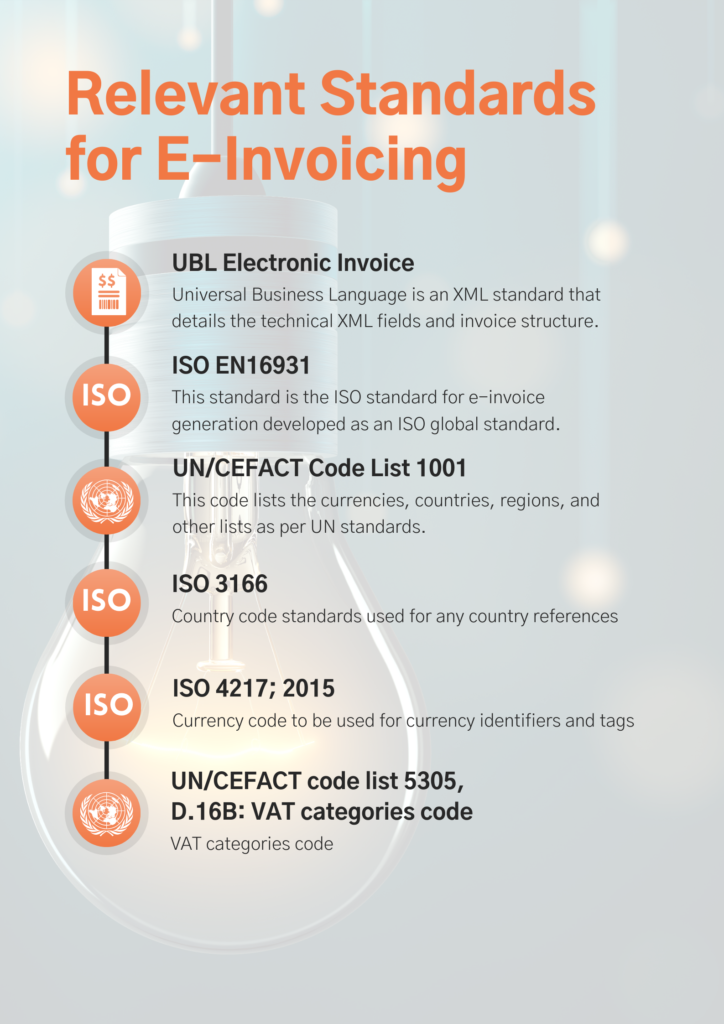

After familiarizing ourselves with the definition of e-invoice as per GAZT, the characteristics of an e-invoice and the electronic language used to generate an e-invoice, let us now move on to our 2nd most important point regarding the implementation of e-invoicing: i.e., the relevant standards required to be met for an e-invoice as per the GAZT.

2. Relevant standards for E–Invoice

There are global standards that are generally used for e-invoicing and GAZT has also referred to the same.

It is important to understand here which rules takes precedence over the others as mentioned below.

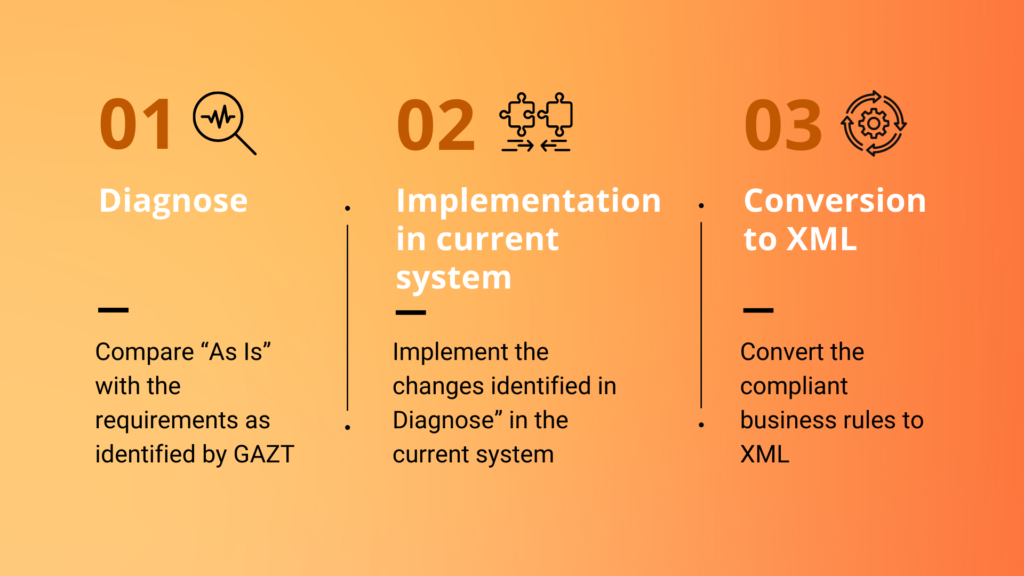

Now that we have understood the definition of e-invoice, the characteristics of e-invoice and the required standards, the question now is how to move forward. In this context, the 3rd most important item to be known is: the right approach that must be followed for handling the implementation of the e-invoicing project.

3. How to Approach the project

Following is our recommended approach for the successful implementation of the e-invoicing as per the GAZT regulations.

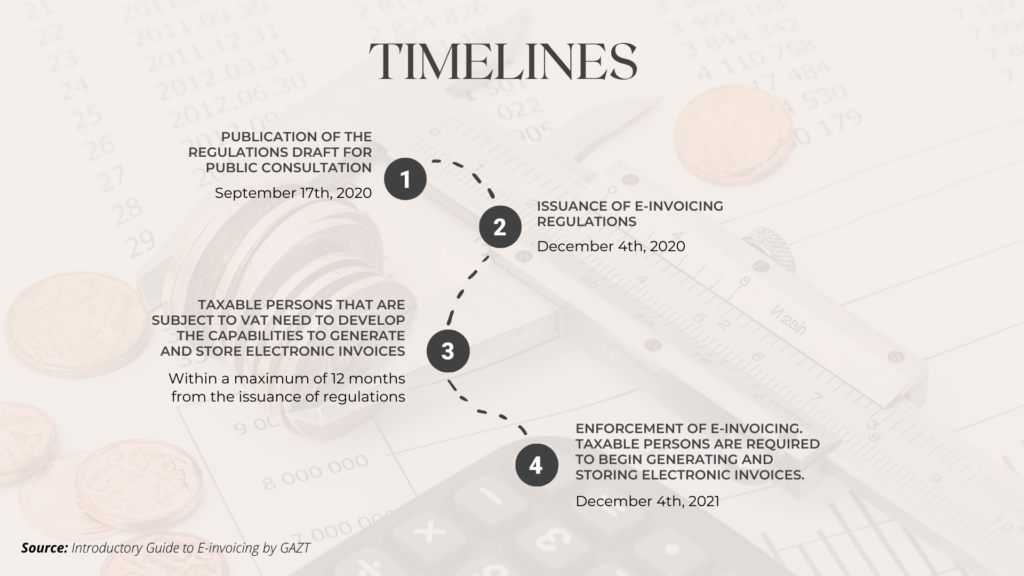

Following are the timelines for the complete implementation of the e-invoicing throughout the KSA.