OVERVIEW

In 2013, SOCPA approved an IFRS convergence plan by which listed entities other than banks and insurance companies would be required to report under SOCPA standards from January 1, 2017 and SMEs’ by January 01,2018, that will be IFRSs with some modifications – “IFRS as adopted in Saudi Arabia”.

IFRS in Saudi Arabia will be similar to the standards issued by the IASB with possible modifications in three respects:

- Adding more disclosure requirements

- Removing optional treatments; and

- Amending the requirements that contradict Shariah or local law, taking in consideration level of technical and professional preparedness in the Kingdom

The IFRS transition is part of a project called “SOCPA project for transition to International Accounting and Auditing Standards”.

TIMELINES

Now is the time!

All SMEs’ are required to be IFRS compliant in 2018.

It entails a thorough and robust planning as a Company who is required to adopt IFRS – from 1 January 2018, requires comparative financial information for the year ended 31 December 2017 and an opening balance sheet at 1 January 2017.

IFRS TRANSITION – IS IT JUST AN ACCOUNTING JOURNEY?

Although the end result is the preparation of uniform and transparent financial information for shareholders, investors and all other stakeholders; the process does impact various business domains.

Some of the examples are

- Generation of required data will test the capability and flexibility of the systems.e.g. component based fixed asset accounting

- Changes in revenue recognition principles require adaptation with culture, sales processes, contract management, performance management and technology solutions.

- Strong coordination between Finance and Contract management teams to understand the implications of lease accounting.

- Development of additional controls within the processes to ensure accurate reporting under the IFRS

- Changes in processes across the entire value chain

HOW CAN WE HELP

- A general understanding of IFRS standards, and analysis of first time adoption options under IFRS 1

- Preliminary diagnostic analysis / impact assessment and recommendations

- Compliance review in the context of legal regulations pertaining to reporting to supervisory authorities

- Support in implementing the new accounting standards, detailed research on specific issues and development of accounting policies

- Assessment of data collection, controls and IT system processes and redesign of new processes

- Preparation/review of skeleton accounts and financial statement disclosures including transition notes

- Development of an IFRS adoption project plan

- Communication of the impacts of the conversion to IFRS to stakeholders (analysts, regulators, funders and owners/ shareholders) and understand the impacts of changes on KPIs

- IFRS Training

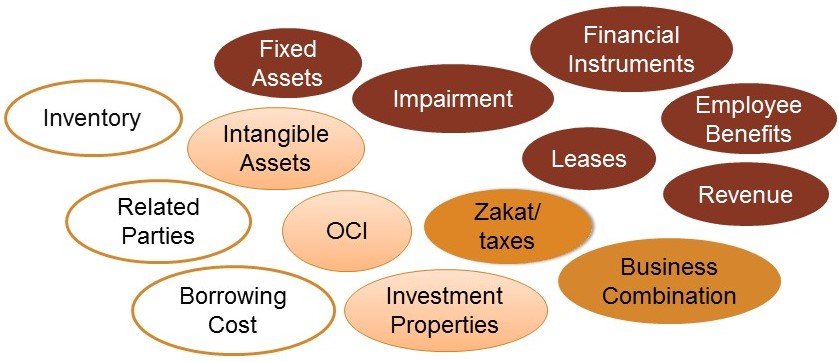

STANDARDS IMPLEMENTATION INDICATIVE COMPLEXITY LANDSCAPE…

WHY US

Successful delivery – The team is currently engaged in successfully delivering on the IFRS conversion assignment for a listed company based in Dammam

Diversity – Core leadership team have an experience of working in Assurance, Financial Reporting and Accounting advisory roles.

They have not only extensively worked in the IFRS environment in various countries but also within Big 4 in Saudi Arabia. Also, have an experience of working with organizations in their IFRS transition phase.

The expertise in various sectors including Oil & Gas, Telecom, Services, Contracting, Petrochemical and manufacturing means that the complex accounting issues will always be professionally dealt with.

Project Management – With the experience of handling various projects amicably including SOX 404 implementation, Finance Transformation and IFRS implementations to name a few, we are well poised for seamless delivery.

Tools & Resources – Our biggest strength is our resources who have wealth of experience in IFRS application. Their knowledge and industry insights means that only the best will be delivered. On top of that we have the rights tools available to manage the transitions process in an efficient way and ensure that there are no surprises

Poised to add value – Not only we consider this as a transition of financial reporting but also an opportunity to devise policies, processes, technology and controls to reshape the way business is run. With our extensive experience in the domains of finance process improvement and Internal Controls we make sure that a sound platform is made available to the clients.